Starkweather & Shepley offers a full range of cost-effective commercial insurance and risk management solutions.

From promising start-ups to established enterprises, businesses depend on Starkweather & Shepley commercial insurance to protect them from loss.

Although our firm has long been considered ‘generalists,’ we have the knowledge, resources, stability, and depth of expertise to provide risk management solutions specially tailored to your specific industry and business needs.

Featured Products

-

Captive Risk Solutions

Learn More -

Collection Protection

Learn More -

Construction Risk Solutions

Learn More -

Dental Risk Solutions

Learn More - General/office liability

- HIPAA defense coverage

- Professional liability for you, your staff and your corporation

- Employment practices liability coverage- defense coverage included, indemnity provision available

- Contractual liability

- Occurrence and claims-made coverage forms available, allowing you to choose what best fits your needs

- State board/licensure coverage

- First aid/medical payments

- And much more!

-

Elder Care Risk Solutions

Learn More -

Employee Benefits

Learn More -

Energy Risk Solutions

Learn More -

Enterprise Insurance for Small Business

Learn More -

Financial Institutions Risk Solutions

Learn More -

Franchise

Learn More -

Healthcare Risk Solutions

Learn More -

Hospitality Risk Solutions

Learn More -

HR Consulting Risk Solutions

Learn More -

Human Services Solutions

Learn More - Adoption Agencies

- Behavioral Healthcare Organizations

- Child Care Centers

- Community Centers

- Developmental Disabilities Providers

- Group Homes

- Home Health Care

- Homeless / Battered Shelters

- Mental Health Organizations

- Non-Profit Organizations

- Religious Organizations

- Social Service Organizations

- Substance Abuse Rehabilitation Facilities

- Theaters

- YMCA / YWCA / YSO

-

Life Asset

Learn More -

Loss Control

Learn More -

Manufacturing Risk Solutions

Learn More -

Marine Risk Solutions

Learn More -

Municipalities Risk Solutions

Learn More -

Real Estate Risk Solutions

Learn More -

Seafood Risk Solutions

Learn More - Stock (perishable)

- General Liability

- Automobile

- Worker’s Compensation

- Crime

- Umbrella

- Accounts Receivable

- Product Rejection / Recall

-

Surety & Bond

Learn More -

Technology/Life Science

Learn More -

Theatre, Arts, Culture, & Entertainment Risk Solutions

Learn More -

Transportation Risk Solutions

Learn More

Captive Risk Solutions

Through our partnership with Innovative Captive Strategies (ICS), Starkweather & Shepley can advise you as to whether or not a Captive Insurance alternative makes sense for you. A Captive Insurance Company is a specialized purpose insurance company whose primary role is to insure or reinsure the retained risk of its owners. In other words, it is a risk financing mechanism used as an alternative to traditional insurance.

Construction Risk Solutions

Construction has been a primary focus for Starkweather & Shepley since 1879.

Innovative risk management programs, insightful advice, appropriate coverage, and quick turnaround for construction projects – it’s precisely what you would expect from your insurance broker … a broker who listens.

Starkweather & Shepley understands the risks associated with construction projects. Providing adequate coverage is essential, but keeping costs to a minimum is a priority. We work with you to manage the risks associated with running a construction company.

Ready to talk about Construction Risks?

Dental Risk Solutions

Professional liability insurance is available through the Professional Protector Plan ®, one of the oldest and largest dental professional liability programs in the country. The Professional Protector Plan sets the standard for outstanding coverage, superior claim service, dedicated legal counsel, comprehensive risk management training and useful, value-added features.

Base coverage features include:

Elder Care Risk Solutions

Starkweather & Shepley’s Eldercare Risk Solutions is dedicated to Insuring nursing homes, eldercare/rehabilitation facilities, and assisted living homes, by providing the best in class solutions, resources, and educational programs to meet the ever increasing risk management needs of organizations like yours. Our team has the resources to develop a comprehensive risk management program for you and offers specialized programs that fill the gaps that often exist in standard policies.

Employee Benefits

Starkweather Benefits Solutions brings the finely honed client focus of Starkweather & Shepley into the Employee Benefits arena. Our unique combination of practical experience and professional expertise enables us to completely understand the challenges facing employers, and guide them to the best options. We strive to provide data-driven, creative solutions for our clients so they can make well-informed choices that benefit both their employees and their bottom line.

Energy Risk Solutions

Starkweather Energy Risk Solutions is focused on insuring Fuel Oil Dealers, Propane Dealers, C- Store Operators and Gasoline Haulers, HVAC Service and Installation companies, Solar Installers and those who also sell kerosene or wood pellets. We have the resources to develop a comprehensive Risk Management program for your energy-related business so that you can run a safer organization and maintain your profitability.

Financial Institutions Risk Solutions

The Financial Institutions Practice Group is committed to working with established firms, start-ups, and breakaways within the financial community to identify their specific insurance needs and assist with risk solutions. We use our well established market relationships to secure options for coverage that mitigates the risk of operating as a business.

Franchise

Franchisors, franchisees and associations all have unique insurance needs and a significant investment to protect. Starkweather & Shepley customizes insurance programs for organizations and franchises wishing to take advantage of their leverage and potential buying power. You and your franchisees or association members can benefit greatly from broader coverages, preferred rates, and superior claims services provided by the nation’s leading carriers by initiating franchise/affinity group programs.

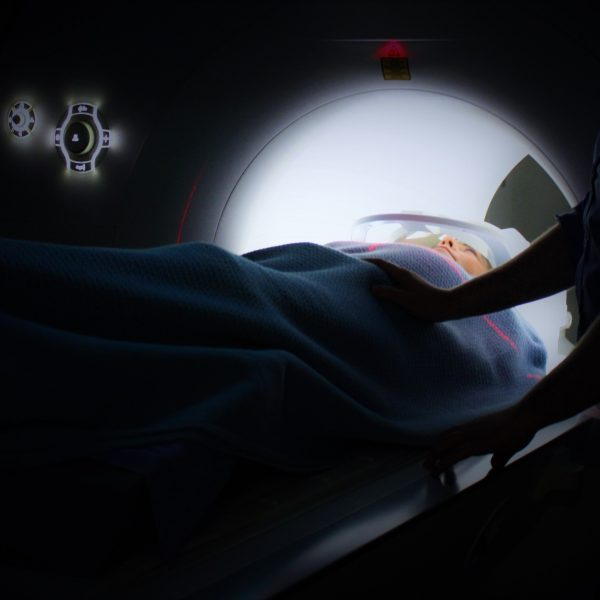

Healthcare Risk Solutions

Perhaps no other industry understands “risk” more than those in the health care field. Life and death decisions are routinely made and every activity in your profession is monitored and scrutinized – leaving you vulnerable and exposed.

Starkweather Healthcare Risk Solutions is dedicated to insuring Healthcare/Medical Professionals by providing the best-in-class solutions, resources, and educational programs to meet the ever-increasing risk management needs of organizations like yours.

Hospitality Risk Solutions

We understand how hard it is to run a small business and that’s why it’s so important to find an insurance broker you can trust. Too often and many times too late, restaurateurs and retailers find off-the-shelf insurance programs don’t cover their businesses adequately. Starkweather & Shepley has been working with retailers and restaurateurs since 1879 and we understand their specific needs.

Human Services Solutions

Starkweather Human Services Solutions was established to support key segments of the Not-For-Profit human services community in their quest to access a wide range of risk management and insurance products offered by industry leading carriers.

Starkweather Human Services Solutions focuses on the following human services Industry segments:

Life Asset

We assist our clients in the design, implementation and administration of executive benefit and personal insurance plans. Our consultants and business partners analyze and create plans to meet the needs of individuals as well as private practices and corporations of every size and industry.

We understand the important and appropriate steps to developing strategic programs that provide comprehensive coverage as well as savings opportunities. We analyze all available options to design the solution that most effectively meets the financial objectives behind each plan.

Manufacturing Risk Solutions

Starkweather & Shepley was founded in 1879 when James Starkweather, a manufacturer, and George Shepley, an insurance man came together to create an insurance agency that changed the way people in Rhode Island would think about insurance.

In the early 1990’s, the Workers Compensation environment in Rhode Island was terrible. Most manufacturers were forced into the assigned risk pool because no insurance carriers would voluntarily write the required coverage. Starkweather was at the forefront of the Self Insured Group (SIG) creation, specifically for the various manufacturing groups, such as SIMA (Self Insured Manufacturers Association), JIRMA (Jewelry Industry Risk Management Association) and BIRMA (Business & Industry Risk Management Association.

Municipalities Risk Solutions

We understand how hard it is to run a business and that’s why it’s so important to find an insurance broker you can trust. Too often, municipalities find that off-the-shelf insurance programs don’t cover their unique loss exposures adequately. Starkweather & Shepley has been working with municipalities since 1879 and we understand their specific needs.

Real Estate Risk Solutions

The industry expertise runs through the entire team structured to service your account. From the account executive to the various brokerage teams to the claims and client advocates, all have extensive real estate industry expertise and experience. These highly-trained individuals are experts in their selected disciplines and coverage lines and provide the support needed to allow you to focus on your business and portfolio. Providing the consultative, risk management approach to our real estate clients enables us to differentiate ourselves from the competition and allows our clients to reap the benefits.

Seafood Risk Solutions

Whether you are an importer, exporter, processor or value-added wholesaler of seafood, Starkweather & Shepley has the insurance companies and experienced personnel in place to effectively assess your business insurance exposures and implement a cost-sensitive program to protect your assets.

Coverages available, but not limited to, include:

Coverage available in all 50 states

Technology/Life Science

There is significant risk in the burgeoning industries of technology and life sciences. Advances in these fields hold great promise for a brighter tomorrow … but the companies who are researching and developing new products need to safeguard their interests and assets today. Starkweather & Shepley takes the time to listen to your needs and provide winning solutions.

The risks involved in life sciences and new technology are best managed through education and experience. Starkweather & Shepley will listen to your concerns and understand your business’s risks using our extensive knowledge in handling risk management programs for companies with worldwide exposure like yours. To arrange a meeting, please contact us.

Our team of “tech” professionals will guide you through the complex areas of Directors & Officers Liability, Clinical Trials, Errors & Omissions, Product Recall, and e-commerce. Starkweather understands the unique risks and rapidly changing trends associated with your industry.

Theatre, Arts, Culture, & Entertainment Risk Solutions

As an owner or operator of a theater, having the proper insurance coverage and risk management plan will keep the show going. Starkweather & Shepley has the knowledge and skills to insure: theaters, theater companies and not-for-profit theater groups.

Each of our Theater Insurance policies is customized to fit your unique exposures. From people, property and productions to administration and financing, we work with you to develop unique risk protection including Dance Liability Insurance, Opera Insurance or Performing Arts Insurance. To cover everything you do.

Transportation Risk Solutions

Your industry is unique and your insurance program cannot be treated like a commodity. We provide comprehensive risk management and loss control solutions for the transportation industry and auto dealerships. We specialize in local and intermediate trucking operations and auto dealerships who want complete coverage coupled with excellent customer service. We have the expertise and understand the importance of Federal and State filings and the impact of your DOT score on your insurance program.